Asset Allocation

The Importance of Diversification Within and Among Asset Classes

Asset allocation is the process of selecting a mix of asset classes that closely matches your financial profile in terms of your investment preferences and tolerance for risk. It is based on the premise that the different asset classes have varying cycles of performance, and that by investing in multiple classes, the overall investment returns will be more stable and less susceptible to adverse movements in any one class.

All investments involve some sort of risk, whether it’s market risk, interest risk, inflation risk, liquidity risk, currency risk, legislative/political risk, and many others. An individualized asset allocation strategy seeks to mitigate the risks of any one asset class though diversification and balance.

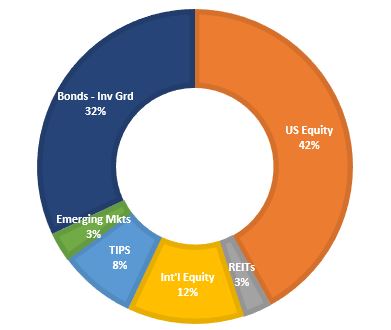

Investment Portfolio Asset Classes

Percentage Assigned to the Asset Classes

We start with what we consider the default portfolio. For equities, this would be the global market portfolio that includes all publicly traded stocks weighted by their market capitalizations. This portfolio is currently about 53% U.S. and 47% foreign. However, as Americans, we pay far more attention to our own stock market than the foreign markets. Also, we can invest in our own market at a lower cost compared to foreign markets. Recognizing this home bias, Guardian Solutions chooses to make our equity portfolios 75% U.S. and 25% foreign. In Guardian Solutions’s view the 25% allocation is sufficient to capture the diversification benefit of foreign stocks. Within the 25% foreign, we have 20% developed markets and 5% emerging markets, which is roughly proportional to their capitalization in the global portfolio. The next step is to decide how to modify the market-weighted portfolios within each general region. We choose to take a mild to moderate tilt towards the risk factors of small cap, value, and profitability. Based on very long-term historical data, tilting towards these factors should produce higher expected returns. However, tilting too strongly can create a severe tracking error relative to the overall market, which could make the portfolios difficult for investors to hold, especially when small caps lose to large caps, value stocks lose to growth stocks, and high profitability stocks lose to low profitability stocks.

For the bond side of our portfolios, we take a similar approach. We start with the whole bond market but filter out the parts that don’t currently provide an attractive risk/reward profile. We are left with investment grade bonds of short and intermediate maturities. To that, we add Treasury Inflation-Protected Securities (about 20%) to provide a diversification benefit to the nominal bonds, hedge against unexpected inflation, and reasonably match future liabilities faced by our clients.